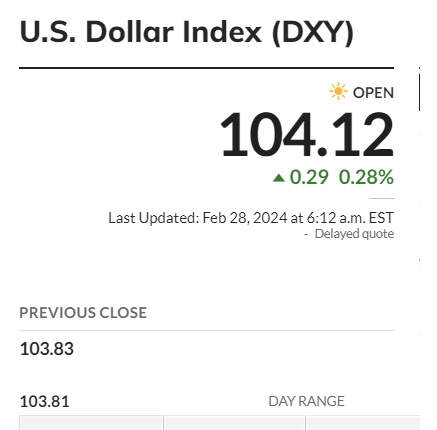

Gold prices are on the back foot on Wednesday as the US dollar strengthens in the indices. The US dollar DXY index touched a high of 104.12 today rising 0.28% in the day’s trade. On the other hand, gold prices saw a slump as the XAU/USD index fell to the $2,027 range. Gold is down more than 3 points shedding -0.15% of its value. The development made the US dollar rise by 0.27 points with an uptick of 0.27%.

Also Read: German Bank Predicts Future of the US Dollar vs Rupee in 2024

Why Are Gold Prices Falling?

The XAU/USD index dipped amid uncertainty over US core PCE price index data. Gold prices fell sharply after the Fed policymakers maintained a hawkish narrative this month. The Federal Reserve is not interested in lowering interest rates at least for the first half of 2024. The move is adding strength to the US dollar despite uncertainty in the global market.

Also Read: Cryptocurrency: 3 Coins To Watch Under $1 as Bitcoin Hits $59,000

The indication kick-started the US dollar’s upward trajectory making DXY climb from a low of 102 to a high of 104.12. The situation remains sticky for gold prices as the precious metal is losing its sheen in the global market. Despite several drawbacks, the US dollar is coming out stronger and trouncing all commodities including gold and oil.

Also Read: BRICS To Take Loans in Chinese Yuan, Ditch US Dollar

The US dollar is also performing well against leading local currencies in the foreign exchange market. This makes the USD attractive to investors while institutions are making profits off of the currency. If the US dollar continues to dominate the market adding pressure on commodities, gold prices could dip to the $1,973 level.

The last XAU/USD came to this level was last year during December 2023. A revisit to the price range will make gold prices experience a sell-off from institutional investors. Read here to know a realistic price prediction on how high or low gold prices could hit this year in 2024.

#Precious #Metal #Falling

#bitcoinnews