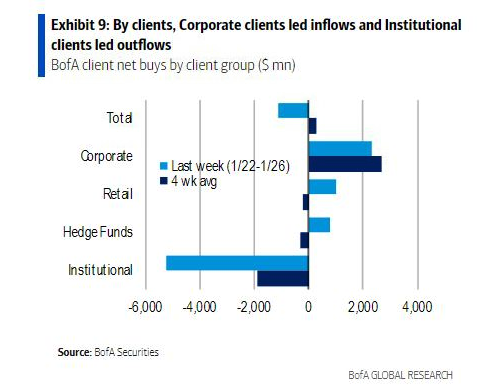

Institutional investors are fleeing the U.S. stock markets at a record pace with the second-highest sell-offs since 2008. This is the second-biggest weekly outflow in U.S. stocks since the market crash that triggered a recession in 2008. The larger U.S. stocks dump from institutional clients came from the technology, securities, and staples sectors. The tech industry is experiencing large-scale job cuts with Microsoft and other giants firing their staff.

Also Read: 34 Countries Look to Join BRICS Alliance After Saudi Arabia’s Entry

“Clients were net sellers of U.S. equities for the first time in three weeks,” reported Bank of America. The banks’ analysts Jill Carey Hall, Nicolas Woods, and Savita Subramanian highlighted that institutional clients primarily ignited the selling.

Also Read: BRICS Control 47% of Global Oil, U.S. Owns Just 2.1%

The recent data from Bank of America also shows that institutional investors did not limit their exit from U.S. stocks alone. Large-scale sell-offs were also triggered in mutual funds and pension funds. The institutional clients were also from insurance companies, and banks across the U.S.

U.S. Stocks Under Spotlight After Institutional Sell-Offs

While the capitalists jumped ship, average investors are worried, thinking that institutions know something that the normal investors don’t. The sell-offs come at a time when several financial analysts are ringing the warning bells of an upcoming recession. This puts the U.S. stocks in a spot where another round of sell-offs could deeply hurt the equities market.

Also Read: Cryptocurrency: Top 3 Coins To Watch In February 2024

The ripple effect could also hit the worldwide markets as the U.S. equity sector is closely knitted globally. A slump in U.S. stocks reflects negatively on the global markets making almost all equities turn red. However, the only beneficiary in this development will be gold as prices for the precious metal could skyrocket.

The gold XAU/USD index already climbed above the $2,050 mark and is now gearing up to hit the $2,070 level. Read here for a realistic price prediction on know how high gold could rise this month in February 2024.

#Institutional #Investors #Dump #U.S #Stocks #Record #Pace

#bitcoinnews