Speculations of a recession have been looming large since 2022 as economists have been repeatedly warning about an upcoming market crash. According to economists, the crash could be more severe than the 2008 economic crisis and replicate the worst recession since 1929. If the market crashes, BRICS will benefit as the US economy will suffer the consequences of their own making. The uncontrolled debt of $34.4 trillion is spiraling leading to other developing countries ditching the US dollar for global trade.

Also Read: BRICS: 20% of Oil Payments Settled in Local Currencies, Not US Dollar

On the heels of the BRICS alliance looking to dominate the world’s financial sector, a macroeconomist shared his views that the US markets could rally one last time before tanking 50% or more. This time around, not all countries will be affected if the US economy crashes as developing countries are increasingly accumulating gold in their reserves. BRICS countries have been the largest buyers of gold since 2022 and are safeguarding their economies from a potential US market crash.

Also Read: BRICS Makes Huge Announcement About Launching New Currency

BRICS: US Markets Could Rally One Last Time Before a Recession Hits

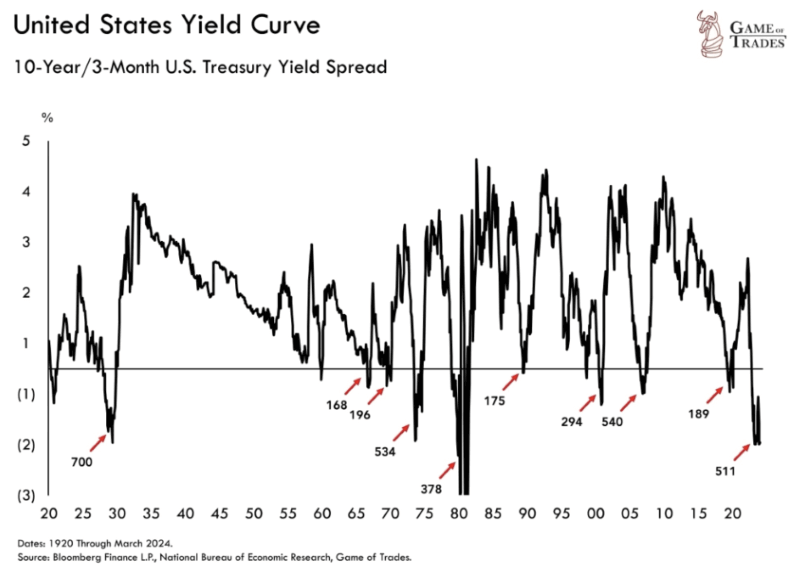

US macroeconomist Henrik Zeberg warned that the American markets could replicate the Great Depression of 1929 in 2024. He listed the observations pointed out by the Game of Trades, which shows similar chart patterns that led to previous market crashes. The BRICS alliance is hoping for the US market to crash to further strengthen its de-dollarization agenda.

Also Read: BRICS: 11 Currencies Dip Against the US Dollar

The forecast of an upcoming market crash explains that the inverted 10-year/3-month US Treasury yield curve has been happening for more than 500 days, which took place just three times since 1920 – in 2008, 1974, and 1929. All the three mentioned periods experienced a market decline of more than 50%. Read here to know how many sectors in the US will be affected if BRICS ditches the dollar for trade if America enters a recession.

Also Read: U.S. Google Moves Jobs to BRICS Countries

“The yield curve has been inverted for +500 days. This has only happened 3 times since 1920:

1. 2008

2. 1929

3. 1974

All 3 saw more than 50% market declines. We expect a final rally to occur before recessionary concerns finally kick in later in 2024,” read the prediction.

#Economist #Predicts #Final #Rally #Markets #Crash

#bitcoinnews