HodlX Guest Post Submit Your Post

As we navigate through the crypto market full of ups and downs, it’s crucial to look at how the number-one crypto holders behave to get to the bottom of Bitcoin’s heartbeat at present and prepare for future market shifts.

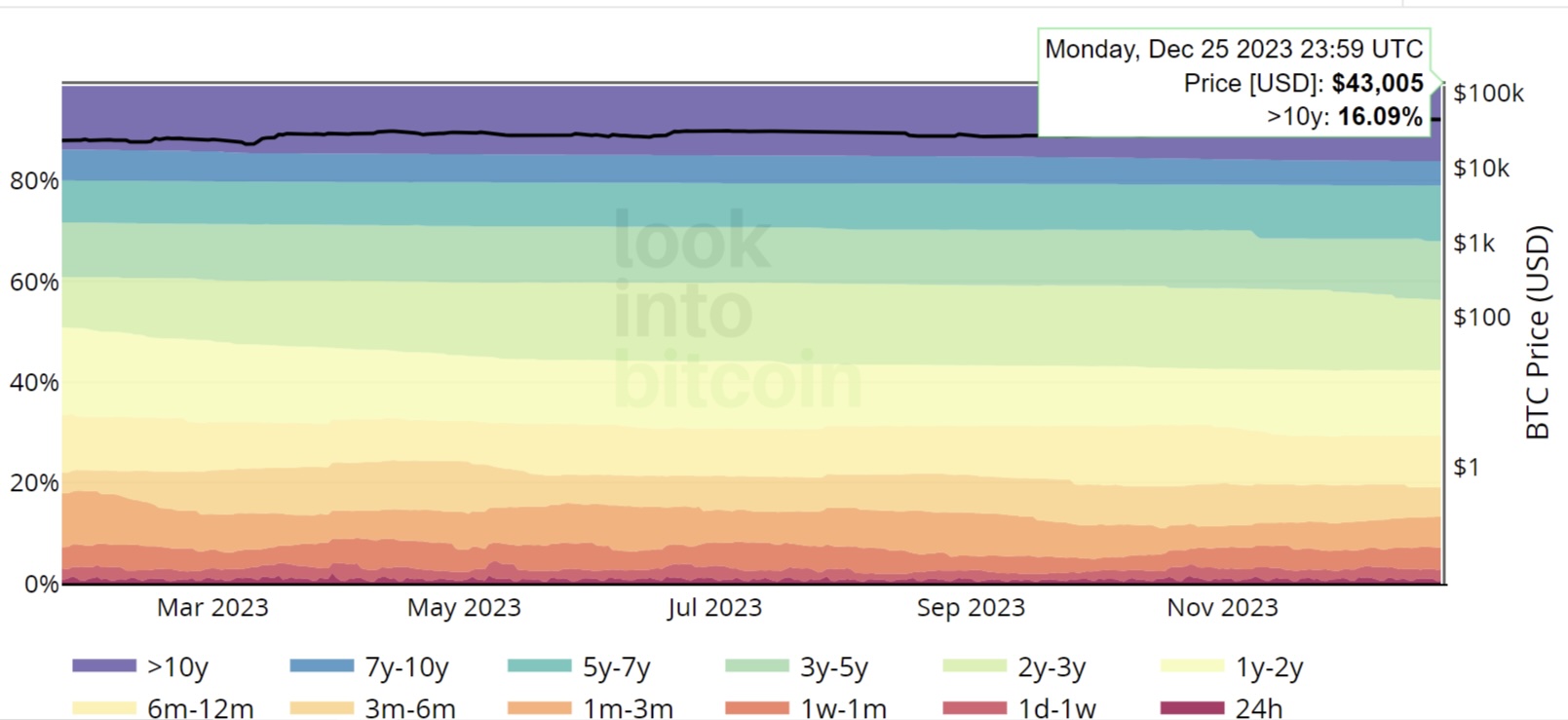

Indicators like Bitcoin HODL Waves use blockchain data to display the amount of BTC in circulation broken down into different age bands. Let’s examine it to see what we can find out.

To start with, let’s define Bitcoin HODL Waves an indicator that basically functions as a mood ring for the Bitcoin economy.

The entire holding history of Bitcoin is layered up in a rainbow that shows not just who’s holding but also for how long.

Source: LookIntoBitcoin

Each color band corresponds to a slice of Bitcoin kept in wallets for a set amount of time.

The OG hodlers, who’ve been holding on to their coins untouched longer than seven years, appear in deep blue and purple on the chart.

The warmer the color, the shorter the time period since the coins were last moved. These waves rise and fall, widen and narrow, just like real waves hitting the shore.

Bitcoin’s old guards are stable ut the middle bands are swaying

Taking a closer look at this chart, we’ve got the elder statesmen of Bitcoin, those holding for more than a decade, currently gripping a solid 16.1% of the total talk about diamond hands.

Then, the seven to 10-year crew are clocking in at 4.9%, a bit of a dip which might hint at some OGs deciding it’s time to skim off the top.

The five to seven-year holders are sitting pretty at 11.0%, while the three to five-year believers have nudged down to 11.8%.

The two to three-year hodlers are nudging up at 13.9%, showing that a bit more of the recent entrants are deciding to stick around.

Now, for the semi-newbies. The one to two-year bracket has a chunky 12.9% not moving an inch.

The six-months to one-yearers are up to 10.4% showing a noticeable shift that maybe they’re starting to catch the hodling bug.

Taking Chainalysis data into account, BTC held for more than 52 weeks has just seen the largest weekly increase over the past six weeks up 76,220 BTC to 13.4 million BTC.

Those who’ve had their hands on Bitcoin for three to six months are holding 5.8%.

Lastly, we’ve got the fresh faces the one-month to three months clutching onto 6.1%, and the shortest BTC holders, who are keeping their coins for less than a week, come in at 2.3%.

What does it all mean? It seems there’s a steady trust in Bitcoin’s long game, with a slight stirring in the middle bands as market sentiment shifts.

A sudden broadening of the younger bands could mean old-timers are cashing out to newcomers.

Unshaken majority signals steady seas ahead

Zooming in, let’s dive into the one-plus-year HODL Wave chart, which is another pulse-check for the seasoned Bitcoiners out there.

What we see is that a whopping 70.6% of Bitcoin hasn’t moved from digital wallets in over a year.

It’s a clear message from the hodlers that they’re not swayed by price swings or the siren songs of market pundits.

They’re in it for the long haul, and that solid orange line cruising across the chart is their battle standard.

Source: LookIntoBitcoin

When over two-thirds of the entire Bitcoin ocean stays calm during storms, it’s a sign that maybe the ship isn’t going to sink anytime soon.

This kind of investor confidence can be contagious, and it’s what gives the newbies the courage to dip their toes in, even when the water looks a bit frosty.

It’s the crypto equivalent of finding a seasoned sailor in the crow’s nest, calmly scanning the horizon as the waves hit. It says, ‘Relax, we’ve sailed through rougher weather than this.’

A waning euphoria among hodlers

Additionally, an indicator called the RHODL Ratio can add to the puzzle of the whole picture. Recent glimpses into the chart for December 2023 show interesting moves.

On December 6, 2023, the RHODL Ratio peaked at a lofty 2,039.0 but on December 25, it declined to 1,656.8.

Source: LookIntoBitcoin

When RHODL skyrockets, you can almost hear the crowd’s chorus of ‘to the moon.’

But savvy riders know this tune, and they also know that what rockets up must eventually glide back down.

The recent dip in the RHODL Ratio might signal that the chorus has toned down a bit.

Despite this, a tangible sense of anticipation is building towards what 2024 might unveil for Bitcoin’s value.

Some analysts are betting that Bitcoin’s price could hit around $55,000 by the end of next year.

Amid a sea of change, the crypto world balances its cautious stance with high hopes, keeping vigilant yet firmly betting on Bitcoin’s enduring prosperity.

Closing thoughts

If these HODL Waves and the RHODL Ratio are telling us anything, it’s that Bitcoin’s more than just a flash in the pan it’s got a fanbase with some serious staying power.

Whether this means we’ll see a steady climb or another heart-stopping drop, that’s the million-dollar question.

But one thing is certain the seasoned players seem to be holding their cards close, while the newbies are shuffling the deck.

Bitcoin is as much about the belief in its future as it is about the tech behind it. It’s a community, a movement and a cultural phenomenon.

So, whether you’re a hodler, a trader or just crypto-curious, remember that every wave is a page in Bitcoin’s evolving story, one that you are also part of.

Maria Carola is the CEO of StealthEX, an instant, non-custodial cryptocurrency exchange with over 1,300 assets listed. After graduating from the University of Vilnius, Maria spent almost a decade in the crypto space, working in marketing and management for a variety of blockchain projects including wallets, exchanges and aggregators.

Follow Us on Twitter Facebook Telegram

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

#Pulse #Bitcoin #Understanding #Current #Market #Trends #HODL #Behavior

#bitcoinnews